Beyond Compliance in the Finance Sector

A review of statements produced by asset managers under the UK Modern Slavery Act

Modern slavery represents a tragic market failure, where some companies maintain competitive advantage and large profits through unethical and unsustainable business practices that rely on forced labour exploitation.

The finance sector has not been subject to the same level of scrutiny as sectors that are high-risk for labour exploitation. But financial actors, and asset managers in particular, have the leverage, and increasingly the responsibility, to push for better human and labour rights practices by companies within their portfolios.

In partnership with WikiRate and the Business & Human Rights Resource Centre we have assessed the statements produced by 79 asset managers required to report under the UK Modern Slavery Act. This is to understand the level of awareness of modern slavery risks, to identify good practice, and highlight gaps in reporting by asset managers.

53%

failed to meet all minimum requirements of the MSA

28%

failed to disclose policies to address modern slavery in direct operations or supply chains

54%

did not disclose due diligence to address modern slavery risks in their supply chains

51%

conducted some type of risk assessment on their supply chains, but only 30% of these then identified specific risks

27%

disclosed conducting some form of due diligence on human rights or modern slavery in their portfolio

15%

disclosed engaging directly with investee companies to address modern slavery through social audits, self-assessment reviews, filing shareholder resolutions, or training

Explore our data

To explore the full dataset, visit the asset manager dashboard on WikiRate.

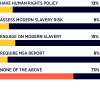

Companies meeting minimum requirements

Do the statements meet the minimum requirements?

Modern slavery due diligence processes in investments

What due diligence processes in investments are disclosed by the statements?

Recommendations

For asset managers

- Comply with the UK Modern Slavery Act and improve their modern slavery reporting in meeting the minimum requirements, disclosing risks, and improving transparency of ownership structures.

- Strengthen efforts to address modern slavery risks in direct operations, supply chains, and business relationships, specifically in financial activities, including investment portfolio, and complex supply chains.

- Engage and share good practice with industry initiatives and collaborations, such as PRI, Finance Against Slavery and Trafficking and Investors Against Slavery and Trafficking.

Contribute to the project

Conduct research on the Modern Slavery Act project via WikiRate.

Share our Business & Investor Toolkit

Share our Business & Investor Toolkit for companies in taking action to address modern slavery in their supply chains.

“The report, ‘Beyond Compliance in the Finance Sector’, produced by Walk Free, WikiRate, and BHRRC is very timely- there remains confusion about the fiduciary duties of investors, and how they can include ESG factors, including modern slavery, in their investment decision-making. The report highlights that investors should recognise the leverage they have to strengthen their efforts to address modern slavery risks in their financial activities, including investment portfolios, and their supply chains.

At PRI, we have highlighted the importance of considering human rights issues in investment decision making. Many investors recognise that preventing and mitigating actual and potential negative outcomes for people leads to better financial risk management and aligns their activities with the demands of beneficiaries, clients and regulators. Our signatories have made it clear that PRI should focus on social issues, including modern slavery, and this reports further highlights the need for social issues to come to the fore in investment decisions in order to deliver on the achievement of the SDGs and the eradication of modern slavery.”

Fiona Reynolds, CEO at the UN Principles for Responsible Investment (PRI)